Spartoo: initial public offering on Euronext Growth to finance its diversification away from footwear<

Spartoo: IPO project on Euronext Paris

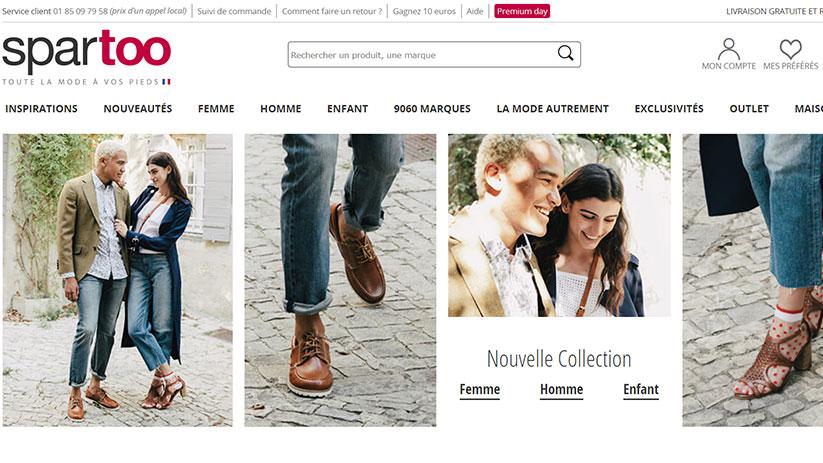

Spartoo, the online retailer specializing in shoes and fashion items, has announced the success of its IPO on Euronext Growth, the compartment of the Paris Stock Exchange dedicated to growth companies.

In this context, the group – created in 2006 in Grenoble (Isère), the city in which it is still based – indicated that it had carried out a capital increase of 23.7 million euros (i.e. slightly less than the 25 million euros initially targeted), via the issue of 3,636,363 new ordinary shares. Nearly 10 million euros were already secured with two investors.

“This is a major step in the history of Spartoo which has just been successfully completed today and we are delighted to be able to benefit from the advantages linked to the listing on the Stock Exchange which will act as an unparalleled catalyst for our development” , reacted Boris Saragaglia, CEO and co-founder of Spartoo, in a press release. "These new financial resources will enable us, in particular, to strengthen our product offering, increase our notoriety through advertising investments and support the growth of our service offering dedicated to professionals", and thus "to establish our position among the market leaders in the sale of footwear and fashion items on the Internet,” he continued.

The last fundraising to date undertaken by Spartoo dates back to 2011. At the time, the group had raised 25 million euros from all of the group's historical shareholders (A Plus Finance, CM-CIC Capital Privé, Highland Partners, Endeavor Vision). An operation in which the Belgian investment company Sofina has also joined, today a shareholder of Spartoo with a stake of 18.10% of the capital.

Spartoo share price (ALSPT, FR00140043Y1)

Spartoo shares (Codes: ALSPT, FR00140043Y1) are displayed at a unit price of 6.53 euros. The group had set an indicative price range of between 6.53 euros and 7.22 euros. Individuals could therefore subscribe as part of an open price offer (OPO).

Taking into account the full exercise of the extension clause, the selling shareholders sold 545,454 ordinary shares. This made it possible to increase the size of the offer to 27.3 million euros, broken down as follows:

After the successful capital increase, the market capitalization of Spartoo reaches approximately 118.7 million euros.

The free float (share held by the public, Ed) represents 21% of the company's capital. It could be increased to approximately 24% of the capital in the event of the full exercise of the over-allotment option (on a diluted basis).

Spartoo, a major player in French e-commerce

Spartoo is one of the French pioneers in the sale of shoes on the Internet. Its name refers to the Spartan, this light sandalette which was part of the costume of Spartan warriors in ancient Greece. The group was created in 2006 (one year after the other French player in the Sarenza sector and two years after their German counterpart Zalando) by Boris Saragaglia, still present within the company as Chief Executive Officer (CEO), and two student friends, Paul Lorne (supply manager) and Jérémie Touchard (in charge of search engine listing).

Subsequently, Spartoo expanded its range by also offering online sales of clothing, leather goods and accessories from the fashion world. In addition to Internet sales, the group manages six stores in its own name (Besançon, Chambéry, Dijon, Clermont-Ferrand, Grenoble and Lieusaint) and three corners located within the "Printemps" shopping malls (Brest, Metz and Tours) . Recently, Spartoo has expanded its offer to new product lines including beauty and interior design.

Present in more than thirty countries, Spartoo has just over 400 employees of 26 nationalities. The Isère giant boasts "one of the widest choices of fashion items in France and Europe", with nearly 8,000 brands and some 700,000 references. The group, which once owned the shoemaker André, acquired the brands JM Martin and Christian Pellet in early 2021.

Spartoo: double-digit growth, but strong competition

With some three million pairs of shoes sold in 2020 and an audience of 14 million unique visitors per month, the e-merchant Spartoo claims to benefit from a solid growth dynamic.

How To Prepare Homemade Tater Tots – E Blog Line https://t.co/oXfCoFPN29

— EBlogLine Thu Nov 26 08:05:59 +0000 2015

This enabled it to achieve, thanks to its "digital native" positioning (coming from the generation that grew up at the same time as the development of the Internet) in the sale of fashion items, a gross volume of merchandise of 194 million euros in 2020, of which 39% was achieved internationally (mainly in Germany, Italy and Spain, but also in China). The figures were respectively €166.2 million and €177.4 million in 2018 and 2019.

The group also recorded pro forma consolidated revenue of 134 million euros in 2020 (up 10% compared to 2019). For the year 2021, he hopes to achieve growth of more than 10% compared to the current financial year. It is even more optimistic for the 2021-2024 period, with an objective of growth in its gross volume of goods of more than 15% per year, despite the crisis experienced by the sector.

Spartoo also indicates that it has generated a positive adjusted Ebitda (gross operating result) since 2014. By the end of 2024, it even plans to generate a gross operating profit of 7% (vs 4.7% in 2020). ).

The fact remains that the group must combine with fierce competition, both from established competitors (Zalando, Sarenza, H&M, Amazon, Alibaba, etc.) but also from new entrants who also offer a globally homogeneous product offer – shoes , ready-to-wear and accessories. Another determining factor: more and more of Spartoo's partner brands are selling their products directly to customers through channels other than the marketplace developed by the group. This could ultimately have an adverse impact on Spartoo's business, financial condition and results of operations.

But Spartoo nevertheless relies on solid assets to meet this competitive challenge:

Use of fundraising proceeds by Spartoo

Spartoo intends to use the net proceeds of its capital increase, i.e. €22.2 million (based on the midpoint of the indicative offer price range) as follows:

Interview: Boris Saragaglia, CEO and co-founder of Spartoo

Boris Saragaglia, CEO and co-founder of Spartoo

What are the advantages of Spartoo?

First of all, the group, which I founded in 2006 in Grenoble with two study friends – Paul Lorne and Jérémie Touchard, still at the helm alongside me – carries our entrepreneurial DNA. By dint of persistence, we succeeded in transforming this company into one of the current leaders in the sale of shoes and fashion items online in Europe. Profitable since 2014, Spartoo also has a real strategy for developing its own brands, alongside the acquisition of brands with a strong heritage, such as JB Martin and Christian Pellé, which we took over in 2020.

What is the typical profile of your clientele?

Our core target is the 35-year-old urban woman, CSP+, who buys for herself, for her children and for her loved ones. But we do not neglect our male customers, who can find what they are looking for among our many references.

Why is the IPO an important step?

This is a new stage in our adventure. This is a good opportunity to raise capital, knowing that our last fundraising dates back to 2012. We hope to raise 25 million euros, of which 10 million euros have already been secured with two investors, Financière Arbevel and Amiral Management. For us, this operation is above all a growth accelerator. With 50 to 60% of the money collected, we intend to accelerate our development in our core business, footwear, which today represents 80% of our activity, while launching new product categories, such as interior decoration. We will also continue to develop our brand acquisition strategy.

You are not scalded by the failure of the takeover of André in 2018?

We learned a lot from this episode, which should not prevent us from moving forward. The stock market is the ideal lever to give us the means to increase our sales, but also our notoriety. We will seek to increase our market share on the Internet while pursuing our omnichannel strategy by opening new stores, at the rate of five per year on average over the next few years. Coupled with television or radio advertising expenditure, this should represent 35 to 45% of the money raised as part of this IPO.

You also intend to pursue your strategy of internalizing the value chain…

Our logistics functions, as well as our customer service are already fully integrated into our organization. Our customer approach, objectified by a very high level of satisfaction, is supported by the control of the entire value chain, including transport, logistics and after-sales service. This allows us to better control delivery times, but also to boost the repeat purchase rate. Furthermore, in order to capitalize on our know-how in e-commerce, we intend to develop services on behalf of third parties. Through our e-commerce solutions developed in-house, we offer our partner companies to accelerate their development and their online activity thanks to a complete range of services covering logistics, transport and the digitalization of physical points of sale. .

What goals are you setting?

We are aiming for a 10% increase in our business volume this year, and we expect growth of more than 15% per year over the period 2021-2024. These forecasts are rather conservative, as our business volume took off by 30% in the first quarter of 2021.

IPO Spartoo: ISIN code, terms, timetable

Terms of the IPO of the Spartoo group

IPO dates

The indicative timetable for the operation, indicated in the press release, corresponds to the following deadlines:

Tags:

Tags: Prev

Prev